Get the free fillable personal net worth statement

Show details

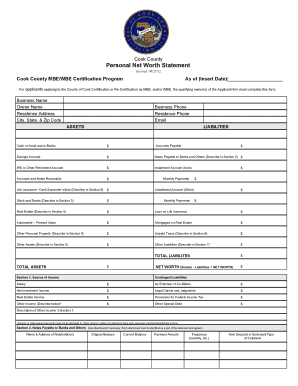

PERSONAL NET WORTH STATEMENT Complete a form for 1 each socially disadvantaged proprietor or 2 each socially disadvantaged limited and general partner whose combined interest total 51 or more or 3 each socially disadvantaged stockholder owning 51 or more of voting stock. Name Date Residence Address Residence Phone City State Zip Code Business Name Business Phone PERSONAL FINANCIAL STATEMENT As of Date //. In determining net worth EXCLUDE individual ownership interest in the applicant...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign financial net worth form

Edit your personal net worth dbe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your worth statement maker form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal net worth statement download online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal net statement download form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal net worth statement blank form

How to fill out Personal Net Worth Statement

01

Start by gathering all financial documents related to your assets and liabilities.

02

List all assets, including cash, real estate, investments, and personal belongings, and assign a value to each.

03

List all liabilities, including loans, credit card debt, and mortgages, detailing the amount owed for each.

04

Calculate your total assets by adding up the values from your asset list.

05

Calculate your total liabilities by adding up the amounts from your liabilities list.

06

Subtract total liabilities from total assets to determine your net worth.

07

Review and update the statement regularly to reflect any changes in financial status.

Who needs Personal Net Worth Statement?

01

Individuals seeking to understand their financial position.

02

People applying for loans or mortgages.

03

Financial planners and advisors for client assessments.

04

Entrepreneurs who need to present financial health to stakeholders.

05

Anyone interested in asset management or retirement planning.

Fill

where worth statements

: Try Risk Free

People Also Ask about are worth statements

How do you fill out a personal balance sheet?

To create a personal balance sheet: Add the value of all assets. List total under assets. Add the total obligations owed. List total under liabilities. Subtract the liabilities from the total assets to determine net worth. List the amount under personal equity.

What is the simple net worth statement?

An individual's net worth is simply the value that is left after subtracting liabilities from assets. Examples of liabilities include debts like mortgages, credit card balances, student loans, and car loans. Liabilities can also include obligations that must be paid such as bills and taxes.

Do you add total liabilities and net worth?

To calculate your net worth, you subtract your total liabilities from your total assets. Total assets will include your investments, savings, cash deposits, and any equity that you have in a home, car, or other similar assets. Total liabilities would include any debt, such as student loans and credit card debt.

What are the parts of a personal net worth statement?

It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets. Your net worth can be either positive (if you have more assets than liabilities) or negative (if you have more liabilities than assets).

What is an example of a personal net worth statement?

For example, if the list of everything you own has a total value of $100,000 and the list of everything you owe has a value of $60,000, your net worth statement would show that you have a current net worth of $40,000.

What is a personal net worth statement document?

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send worth statement statements for eSignature?

To distribute your personal s worth sample, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit personal s worth in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing online personal net worth calculator and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit dbe personal net worth statement on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign net worth statement forms. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Personal Net Worth Statement?

A Personal Net Worth Statement is a financial document that provides a summary of an individual's total assets and liabilities, thereby calculating their net worth.

Who is required to file Personal Net Worth Statement?

Individuals seeking certain federal contracts or programs, particularly those that aim to promote small and disadvantaged businesses, are often required to file a Personal Net Worth Statement.

How to fill out Personal Net Worth Statement?

To fill out a Personal Net Worth Statement, individuals must list all their assets, such as cash, properties, investments, and personal property, alongside their liabilities, which include debts and financial obligations, to arrive at a total net worth.

What is the purpose of Personal Net Worth Statement?

The purpose of a Personal Net Worth Statement is to provide a clear picture of an individual's financial status, which can be used for various applications, including loan eligibility, federal contracting, and personal finance management.

What information must be reported on Personal Net Worth Statement?

The Personal Net Worth Statement must report details on all assets (cash, real estate, vehicles, investments) and liabilities (mortgages, loans, credit card debt) to accurately assess an individual’s net worth.

Fill out your Personal Net Worth Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Statement Of Net Worth Template is not the form you're looking for?Search for another form here.

Keywords relevant to personal net worth statement template

Related to usdot personal net worth statement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.